An accounting AI bot is an intelligent assistant designed to help you handle everyday accounting tasks using artificial intelligence. Whether you’re running a small business, part of a finance team, or managing multiple clients at an accounting firm, these bots are changing how accounting is done—saving time, increasing accuracy, and cutting down on manual work.

These bots can generate reports, answer accounting questions, classify transactions, and assist with invoicing and taxes. Some even integrate directly into platforms you already use, like Slack or your accounting software, making them a flexible part of your existing processes.

MORE: AI Billing

With the rise of machine learning, today’s bots don’t just follow static rules—they learn from your accounting data, recognize patterns, and improve over time. That makes them especially valuable for repetitive or time-consuming tasks like manual data entry, budgeting, or expense tracking.

More accounting firms are adopting this technology to give their teams more time to focus on higher-value work like financial analysis, risk management, or client advice. For busy professionals, it’s also a way to reclaim time and improve work-life balance.

Let’s break down how it works and where these bots are making the biggest impact.

What Is an Accounting AI Bot?

An accounting AI bot is a digital assistant powered by artificial intelligence that supports accounting tasks in real time. Unlike traditional accounting software, which follows fixed rules and menus, AI bots interact through natural conversation—whether via chat windows, embedded interfaces, or messaging tools like Slack.

These bots use machine learning and natural language processing to understand your requests and respond like a human would. Ask a bot, “Can you generate a report of last month’s expenses?” and it pulls from your accounting data and financial statements to deliver exactly that—often in seconds.

Where traditional tools may require training, AI bots simplify the process by guiding you through tasks step by step. They can answer accounting questions, provide walk-throughs, and even flag inconsistencies in your data.

Accounting firms and finance teams use them to reduce the time spent on repetitive work while still keeping everything accurate and organized. As these bots learn from past interactions, they get better at understanding your specific needs and systems.

How Accounting AI Bots Work

An accounting AI bot operates using a mix of technologies that allow it to understand, respond to, and act on your requests in real time. The most important components are natural language processing (NLP) and machine learning (ML)—two key branches of artificial intelligence.

NLP allows the bot to interpret everyday language, so you can type or speak questions like “What’s our current budget status?” instead of digging through spreadsheets or complex software menus.

Machine learning helps the bot improve over time by recognizing patterns in accounting data, user behavior, and frequently asked questions.

Most bots connect directly to your accounting software and pull from internal documents such as invoices, ledgers, and financial statements. They can also integrate with larger systems like ERPs, helping automate full accounting processes.

You can access these bots through different platforms, including chat-based tools (like Microsoft Teams), browser extensions, or even via API integrations.

With each interaction, the bot learns more about your business and workflows. This allows it to deliver faster responses, flag irregularities, and provide better assistance with everything from payment tracking to report generation.

Common Use Cases for Accounting AI Bots

Accounting AI bots are built to take over manual tasks and simplify daily work for both accountants and non-accountants. Here are some of the most common ways they’re used across businesses and accounting firms:

Automated data entry assistance: Instead of doing manual data entry, bots pull information from invoices, receipts, and documents to fill in records accurately.

Bank reconciliation support: Bots speed up reconciliation by matching bank transactions to accounting data, reducing the risk of missed entries or duplicates.

Real-time financial report generation: Simply ask the bot to generate reports for expenses, payments, or revenues, and it gathers the data instantly.

Answering accounting FAQs: Whether it’s “How much did we spend last month?” or “When is our next tax deadline?”, bots provide instant responses in chat or through platform integrations.

Expense tracking and approvals: Bots notify managers when expenses need review and help employees track their own spending.

Payment reminders: Get alerts for upcoming payment approvals or overdue bills.

Client communications: Some bots even assist accounting firms with client support, offering quick responses that cut down on phone support time.

These AI-driven tools make automation feel seamless by integrating directly into the accounting software you already use, helping you handle repetitive tasks in less time.

Benefits of Using an Accounting AI Bot

Using an accounting AI bot brings real, measurable benefits to your business or firm. First, it saves time by automating repetitive tasks like transaction categorization, invoice tracking, and report generation. That frees up your team to focus on strategy, client interactions, and high-level financial analysis.

MORE: Benefits of AI in Accounting

Second, AI bots improve accuracy. By removing manual tasks, you reduce the risk of typos, double entries, or missed deadlines. These bots follow the same logic every time and flag inconsistencies in your financial data before they become costly errors.

Third, they offer instant help. Instead of waiting for phone support or searching through help docs, you get immediate answers through the bot—whether it’s about taxes, payroll, or software issues.

Fourth, they’re always learning. With artificial intelligence and machine learning, your bot adapts to your habits, systems, and common questions over time.

Finally, they improve your work-life balance by taking the pressure off during busy seasons, helping you spend less time on tedious accounting work and more on growing your business.

Examples of Accounting AI Bots in the Market

There’s no shortage of AI-powered solutions making life easier for accounting firms, bookkeepers, and businesses. Here are four real-world tools changing how professionals approach their daily accounting tasks.

MORE: Accounting AI Solver

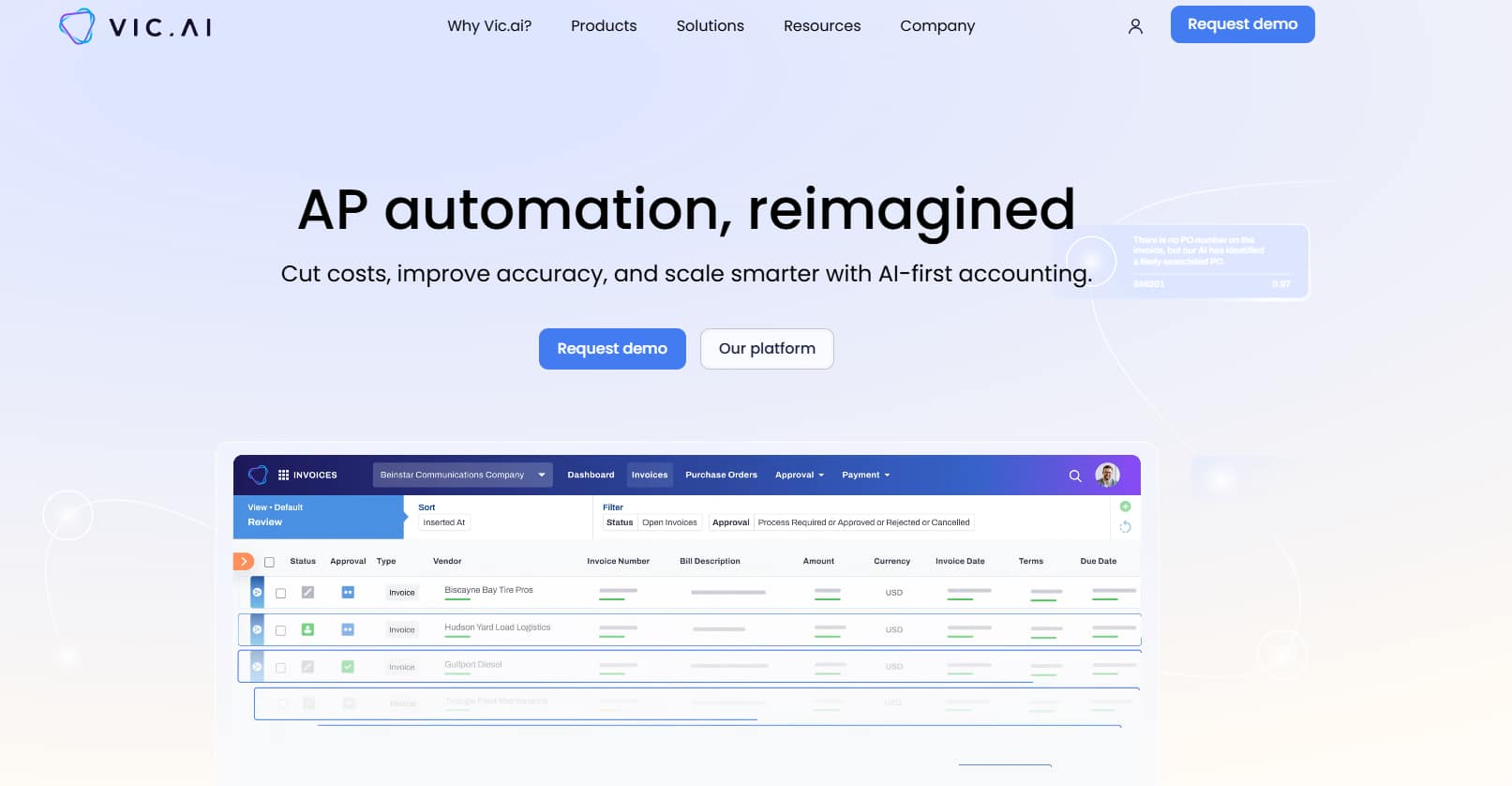

1. Vic.ai

Vic.ai is an advanced artificial intelligence platform focused on automating invoicing, approvals, and expense processing. It’s especially popular with accounts payable teams looking to eliminate manual tasks and reduce errors.

Vic.ai uses machine learning to improve its decision-making over time, identifying patterns in accounting data and suggesting optimizations. The ability to learn from historical data helps companies process documents faster and improve overall accuracy.

Pricing:

Not publicly available.

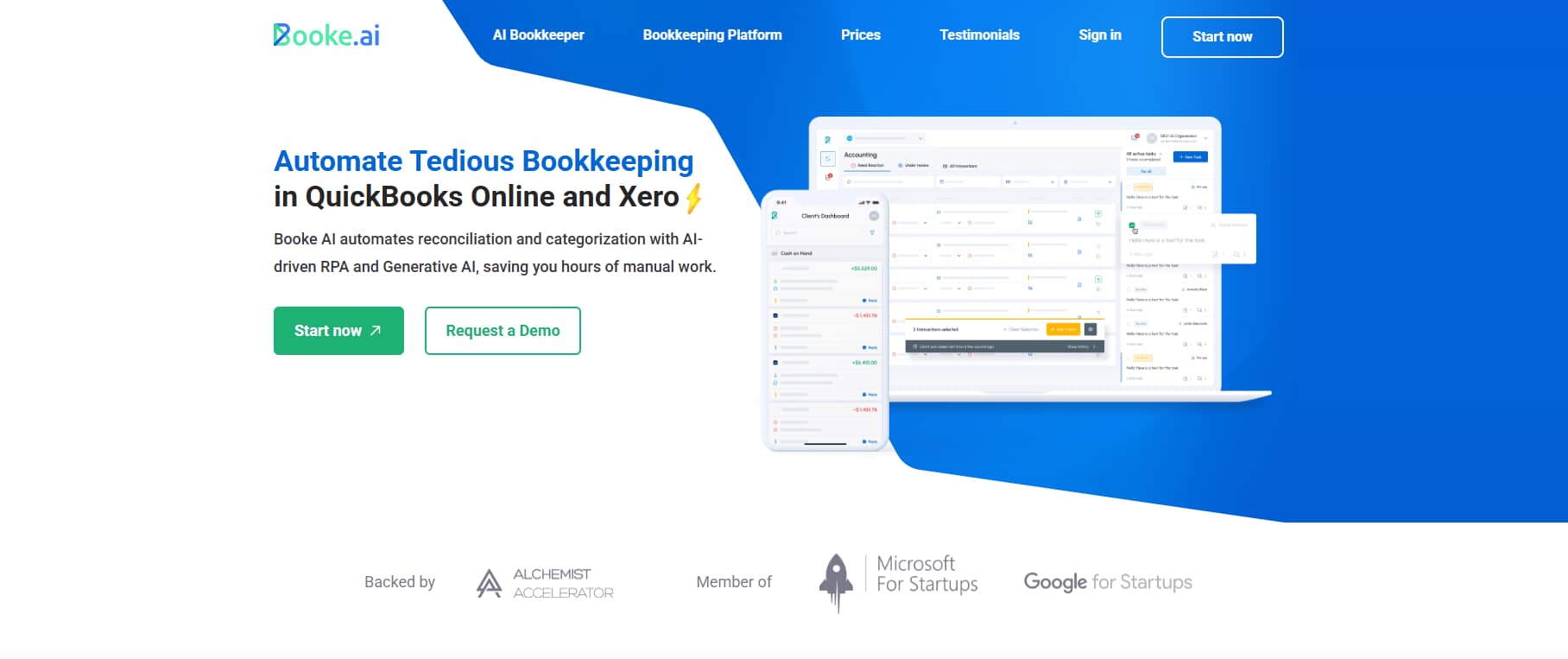

2. Booke.ai

Booke.ai is built for bookkeeping professionals who handle large volumes of transactions. The bot assists with transaction categorization, entry clean-up, and anomaly detection.

It integrates with multiple accounting software platforms and is especially useful for firms managing books for multiple clients. By handling data organization and cleanup, it allows bookkeepers to focus on financial reviews and reporting instead of repetitive corrections.

Pricing:

Prices range from $20 to $50 per month, depending on how many capabilities you want to unlock.

3. Corpay One

Corpay One (previously Roger) is a platform designed for the automation of payment workflows. It helps businesses schedule invoices, set up multi-level approvals, and send reminders.

MORE: AI Invoice Processing

With its integration capabilities, it fits neatly into most accounting ecosystems, allowing SMBs to reduce the time spent managing routine tasks.

Pricing:

Free membership is available for ten or more active cards. If you use less, it will cost $59 per account per month.

4. ChatGPT (Custom GPTs and Finance Plugins)

Custom GPTs and plugins built with ChatGPT are being used by accountants, advisors, and even students. These bots can answer accounting questions, walk through complex reports, and simplify financial analysis.

Some even support generating tax summaries or helping with basic budgeting. It’s a flexible option for those who need fast support without relying on traditional phone support.

Pricing:

The platform offers a free version with limited usage. Paid plans start from $20 per month.

Limitations and Considerations

While accounting AI bots offer clear advantages, there are a few important factors to keep in mind before fully relying on them.

These bots aren’t a replacement for professional judgment. When it comes to interpreting tax laws or ensuring compliance, a qualified accountant is still necessary. AI can support decision-making but shouldn’t be the sole authority for complex financial decisions.

Data security is another concern. If you’re handling sensitive accounting or client data, make sure the platform you’re using is secure, encrypted, and built to industry standards. A misconfigured bot could expose your company to unnecessary risk.

Some bots may also require fine-tuning or initial training to work well with your specific accounting software and workflows. Poor setup can lead to reduced accuracy or missed tasks.

Lastly, integration isn’t always seamless. Not every tool fits perfectly into every tech stack, so it’s important to test compatibility before rolling it out across your team.

FAQs About Accounting AI Bot

What is an accounting AI bot?

An accounting AI bot is a virtual assistant powered by artificial intelligence that performs accounting-related tasks like answering questions, managing invoices, or generating reports. It’s a game changer for reducing admin work and simplifying daily workflows.

Can AI bots handle bookkeeping?

Yes, many bots can assist with bookkeeping tasks like categorizing transactions, reconciling entries, and tracking expenses. These tasks are typically safely managed through integrations with trusted accounting software.

Are accounting AI bots secure?

Security depends on the provider. When built with strong encryption, audit trails, and compliance controls, AI bots can protect your sensitive data and help maintain industry standards.

Who can use an accounting AI bot?

AI bots are used by small business owners, certified public accountants (CPAs), marketing teams tracking budgets, and even students studying finance. They help manage time, improve forecasting, and offer real-time insights for smarter decisions.

Can bots help improve business outcomes?

Absolutely. By automating manual tasks, they free up time to focus on growth, improve sales strategies, and increase overall profits. Some even identify missed deductions or outdated practices, helping you save money while staying efficient—with no limit, thanks to unlimited email and task processing features.